lagu456z.site

News

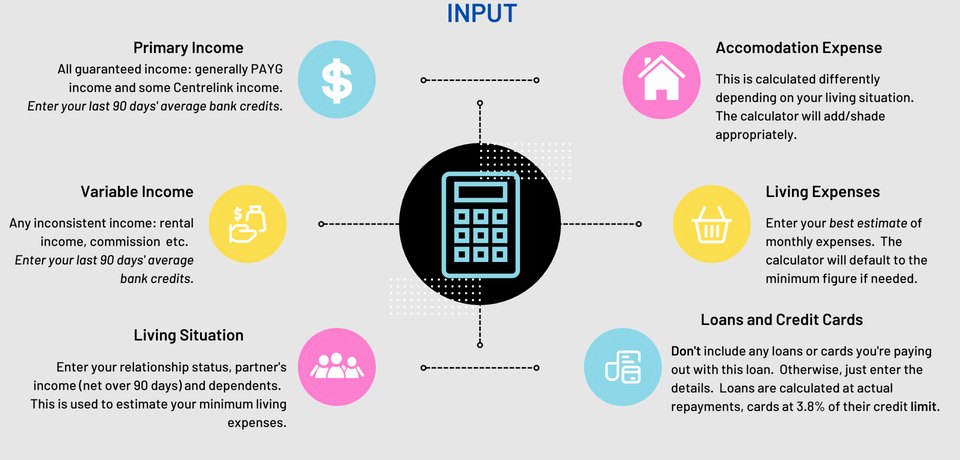

How Much I Can Borrow

Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. How We Calculate Your Home Value. First, we calculate how much money you can borrow based on your income and monthly debt payments; Based on the recommended. How much can I borrow? · You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Estimate your FICO ® Score range. Property amount must be greater than 0, even if it's an estimate. Please reduce your borrowing amount as it exceeds our loan limits for this property's value. Credible's mortgage qualification calculator can arm you with two important bits of information: The mortgage payment you can afford and the size of the home. Use our mortgage calculator to work out your borrowing power, loan repayments, stamp duty and other costs. Work out how much you can borrow online using our secure ANZ Borrowing calculator. The calculator is free and there is no obligation. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. The general rule of thumb with mortgages is that you can borrow up to two and a half () times your annual gross income. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. How We Calculate Your Home Value. First, we calculate how much money you can borrow based on your income and monthly debt payments; Based on the recommended. How much can I borrow? · You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Estimate your FICO ® Score range. Property amount must be greater than 0, even if it's an estimate. Please reduce your borrowing amount as it exceeds our loan limits for this property's value. Credible's mortgage qualification calculator can arm you with two important bits of information: The mortgage payment you can afford and the size of the home. Use our mortgage calculator to work out your borrowing power, loan repayments, stamp duty and other costs. Work out how much you can borrow online using our secure ANZ Borrowing calculator. The calculator is free and there is no obligation. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. The general rule of thumb with mortgages is that you can borrow up to two and a half () times your annual gross income.

Our calculator will show you what you can expect to pay back each month based on the value of your house, deposit, and interest rates. What this means. The amount you could borrow is based on your income increased by a multiplier. Lenders traditionally offer an amount between four and five. borrow. Our affordability calculator will suggest a DTI of 36% by default. You can get an estimate of your debt-to-income ratio using our DTI Calculator. We can give an idea of how much of a mortgage you could get with us if you let us know about your earning and spending. Use our calculator and get started. This calculator can compute the loan amount. Use this calculator to determine how much you can borrow based on your anticipated payments. A tool to help you see how much we may be able to lend to you. Use this calculator to work out how much you might be able to borrow to buy a home, based on your income and expenses. The results from this calculator are. Estimate your borrowing capacity with Commbank's borrowing power calculator. Make informed home buying decisions and plan your finances better! Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Compare home buying options. Our free tool can give an estimate of how large a home loan a lender may be willing to offer to you based on your income and expenditure. Use our online mortgage calculator to get an indication of the maximum amount you could borrow based on your income today. Get a quick quote for how much you could borrow for a property you'll live in, based on your financial situation. Use Bankrate's home equity loan calculator to determine how much you might be able to borrow from your home. Lenders will generally allow you to borrow 80% of your home's current value, minus your outstanding debt. Does equity increase your. Find out how much you could borrow for a mortgage, compare rates and calculate monthly costs using our mortgage calculator. Pre-qualification gives you an overview of your borrowing capacity, while pre-approval guarantees your financing and protects your rate for 90 days. Find out how much you can borrow using our mortgage borrowing calculator, simply by answering a few questions. Mortgage Payment This is the amount that you pay each month that goes toward paying down the principal of the loan and the cost of borrowing (interest). $2, Find out how much you're likely to be able to borrow on your income with Money Saving Expert's mortgage calculator. Generally speaking, your borrowing power is calculated as your net income minus your expenses. Your expenses can be impacted by things like the number of.

Service Based Business Ideas

Home cleaning services · Personal concierge or errand running services · Pet care services · Virtual event planning and coordination · Tutoring or. Here's some ideas for you; garage floor epoxy, bathtub / tile refinishing, painting cabinets, concrete countertops, installing carpet tiles. Some of the most profitable business ideas are website design, cleaning services and real estate. What would be a good small business to start? If you want. Some of the most profitable business ideas that you can execute at a low cost include offering services such as dog walking, photography, tutoring, music. This guide looks at ideas for starting a new business using your skills or experience to provide a sought-after service. One of the most challenging phases of becoming a business owner is deciding what products or services you have to offer. Need some ideas? Amazon Store. Starting an Amazon store is a highly feasible home-based business idea, allowing you to take advantage of the massive customer base and robust. 3. SaaS One of the sexiest recurring revenue business models is what's called SaaS – that means, software as a service. SaaS businesses provide their. The Amazon you know today started with the basic idea of selling books online. Other entrepreneurs have found this to be a profitable niche, too. Video. Home cleaning services · Personal concierge or errand running services · Pet care services · Virtual event planning and coordination · Tutoring or. Here's some ideas for you; garage floor epoxy, bathtub / tile refinishing, painting cabinets, concrete countertops, installing carpet tiles. Some of the most profitable business ideas are website design, cleaning services and real estate. What would be a good small business to start? If you want. Some of the most profitable business ideas that you can execute at a low cost include offering services such as dog walking, photography, tutoring, music. This guide looks at ideas for starting a new business using your skills or experience to provide a sought-after service. One of the most challenging phases of becoming a business owner is deciding what products or services you have to offer. Need some ideas? Amazon Store. Starting an Amazon store is a highly feasible home-based business idea, allowing you to take advantage of the massive customer base and robust. 3. SaaS One of the sexiest recurring revenue business models is what's called SaaS – that means, software as a service. SaaS businesses provide their. The Amazon you know today started with the basic idea of selling books online. Other entrepreneurs have found this to be a profitable niche, too. Video.

An in-person service-based business in a specific locale. Ideas for this kind of business include landscaping services, sewing, photography, housekeeping. If you're well-organized, responsive and detail-oriented, you might consider offering virtual personal assistant services. The virtual PA market is growing and. Some of the most profitable business ideas are website design, cleaning services and real estate. What would be a good small business to start? If you want. based business idea for you. Furthermore, unlike a product-based business which sells physical goods, a service-based business doesn't have manufacturing. Some of the most profitable business ideas are website design, cleaning services and real estate. Home-based businesses tend to be the most convenient and. Businesses need assistance in managing their online presence. Offering social media management services involves creating content, scheduling. Other viable small business ideas for rural areas include agriculture-based businesses, local tourism, and service-based businesses like repair services. The next category of online businesses you can start in is service-based business ideas. This means that you are getting paid to perform a service. While. Have a knack for creating great content online? Create a business profile on Instagram and showcase your services. Look at Gary Vaynerchuk. With his unique. According to lagu456z.site, which lists more than a million freelance projects on its site, the most in-demand freelance services are data entry, academic. Having the skills to cut hair, give manicures, and do makeup enables you to offer home services, which is a great way to start your salon. Having a home-based. The Amazon you know today started with the basic idea of selling books online. Other entrepreneurs have found this to be a profitable niche, too. Video. One of the cheapest ways to start a business is to provide your own services if you have a talent or skill. Melissa Schneider, executive and leadership coach at. Restaurants, car service shops, and the like are all service-based businesses. Collectively, they are relied upon to satisfy the needs and desires of thousands. If you're passionate about being organised and are an experienced administrator, this is a great home-based business idea. To get started, you can list yourself. You can earn a decent profit by offering audio editing services. Many businesses and individuals need help editing projects such as audiobooks, voiceovers. 1. Introduction · Feasibility check - is there a market? · Sense check - do people want or need your product or service? · Test - will customers actually buy your. A wide range of service business ideas and possibilities · Personal services like fitness training, yoga instruction, makeup artistry, hairdressing, and skincare. Examples are financial services, personal services (like personal training or pet care), pet and baby supplies and well-positioned retail stores. No matter the. Similarly, editing and proofreading services are always needed and would make a great small business idea. You can begin by taking on freelance work and go from.

Is The Average American In Debt

Credit card debt statistics show that overall debt is rapidly increasing in the United States, rising by more than $45 billion in Out-of-control spending in Washington is burdening each American with large and growing levels of public debt. A child born in will have a $82, share of. New Experian data finds that Gen X consumers have an average of $ in credit card, auto loans and student loan debt. But with American household balance sheets the strongest in decades, we In the decade since the – financial crisis, the four-quarter average. MILWAUKEE, July 10, /PRNewswire/ -- The average American's personal debt exclusive of mortgages is $21,, which is $8, less than what people. The average college debt among student loan borrowers in America is $32,, according to the Federal Reserve. This is an increase of approximately 20% from. Total household debt rose by $ billion to reach $ trillion, according to the latest Quarterly Report on Household Debt and Credit. Mortgage balances. The average federal student loan debt is $ In total, about 43 million Americans share $ trillion in federal student loan debt. Total household debt rose by $ billion to reach $ trillion, according to the latest Quarterly Report on Household Debt and Credit. Mortgage balances. Credit card debt statistics show that overall debt is rapidly increasing in the United States, rising by more than $45 billion in Out-of-control spending in Washington is burdening each American with large and growing levels of public debt. A child born in will have a $82, share of. New Experian data finds that Gen X consumers have an average of $ in credit card, auto loans and student loan debt. But with American household balance sheets the strongest in decades, we In the decade since the – financial crisis, the four-quarter average. MILWAUKEE, July 10, /PRNewswire/ -- The average American's personal debt exclusive of mortgages is $21,, which is $8, less than what people. The average college debt among student loan borrowers in America is $32,, according to the Federal Reserve. This is an increase of approximately 20% from. Total household debt rose by $ billion to reach $ trillion, according to the latest Quarterly Report on Household Debt and Credit. Mortgage balances. The average federal student loan debt is $ In total, about 43 million Americans share $ trillion in federal student loan debt. Total household debt rose by $ billion to reach $ trillion, according to the latest Quarterly Report on Household Debt and Credit. Mortgage balances.

What is the average American debt? The median household debt in America is $59, This is perhaps alarming considering that the United States median. The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The average American adult owes nearly $,, according to a recent Experian consumer debt study That number may give you sticker shock. But remember that. Older Americans Are Seeing Debt Levels Rise · Those in their 60s have debt levels that have risen by % · And, the total debt burden for people over 70 has gone. The average American household owes $10, in credit card debt, $58, in student loan debt, $, in mortgage debt, and $22, in. Overall, the average annual loan amount awarded to first-time, full-time degree/certificate-seeking undergraduate students who received student loans decreased. Average, Sum, End of Period. Customize data: Write a custom formula to America. Permalink/Embed. Make it responsive. See FRED Help for usage instructions. Average Credit Card Debt in the U.S.: Statistics for The average credit card debt in America is approximately $6, according to recent reports. Credit. 64 million Americans have delinquent debt, but some communities have much larger challenges than others If you liked this, follow along with. Household debt, loans and debt securities. Percent of GDP. map, list, chart. % or more, 75% - %, 50% - 75%, 25% - 50%, less than 25%, no data. What Is the Average Debt in America Per Household? The average amount of debt per household in the U.S. was $, in , according to a report conducted by. The majority of Americans have debt. The total average debt owed by U.S. households as of September was more than $,* The amount and type of debt. All monthly debt, including mortgage cost (principle, interest, taxes, insurance) and other monthly payment debt, should not exceed 36% of monthly income. Debt in Tennessee is not distributed equally—the average debt-to-income ratio of Tennessee metro counties is , lower than rural counties at 4. Tennessee. America's growing debt is the result of simple math — each year, there is a mismatch between spending and revenues. When the federal government spends more than. Consider these statistics about personal debt in America: · More than million Americans have credit cards. · The average credit card holder has at least Among all public university graduates, including those who didn't borrow, the average debt at graduation is $16, To put that amount of debt in perspective. Total credit card debt is now $ billion. Delinquencies – missed payments – ticked up in That shows that many Americans – maybe you? – have too much. Analyzing Debt Trends Across U.S. States · Average Household Debt to Salary Ratio · American Debt By State. Public Debt In America Public debt is a fact of life. The U.S. has had debt since its inception. Our records show that debts incurred during the American.

House Foundation Sinking

It's a foundation failure, likely a pipe burst under there, or a drain, which has washed away the soil underneath the concrete footings do its. Foundation settlement and house movement can occur when one of these soil layers can't support the weight of the home. The problem: Your home is showing signs. In this article, we share the issues of a sinking foundation, including the warning signs and recommended repairs. The biggest culprits in foundation settlement are time and weather. Over time, the weight of the house is going to compress the soil beneath and slightly sink. Homes settle — but the settling should be unified, balanced, and even. If a home is sinking or settling unevenly, this is a sign of a foundation issue. Sinking. A sinking foundation occurs when the foundation begins to settle unevenly into the earth. This phenomenon, known as differential settlement, takes place when. The building foundations may need to be strengthened by transferring the existing foundation depth to a lower much stable subbase level. This. This foundation movement can lead to sinking the entire building. You can notice this happening if you have cracks on your foundation. 2). Cracked Walls. As. If you have cracks in your basement walls or on your interior drywall or plaster walls, that's a major sign your home's foundation may be sinking. (Note that. It's a foundation failure, likely a pipe burst under there, or a drain, which has washed away the soil underneath the concrete footings do its. Foundation settlement and house movement can occur when one of these soil layers can't support the weight of the home. The problem: Your home is showing signs. In this article, we share the issues of a sinking foundation, including the warning signs and recommended repairs. The biggest culprits in foundation settlement are time and weather. Over time, the weight of the house is going to compress the soil beneath and slightly sink. Homes settle — but the settling should be unified, balanced, and even. If a home is sinking or settling unevenly, this is a sign of a foundation issue. Sinking. A sinking foundation occurs when the foundation begins to settle unevenly into the earth. This phenomenon, known as differential settlement, takes place when. The building foundations may need to be strengthened by transferring the existing foundation depth to a lower much stable subbase level. This. This foundation movement can lead to sinking the entire building. You can notice this happening if you have cracks on your foundation. 2). Cracked Walls. As. If you have cracks in your basement walls or on your interior drywall or plaster walls, that's a major sign your home's foundation may be sinking. (Note that.

Identifying & Solving Problems Related To Foundation Sinking & Settlement · Stair-Step Cracks In Brick Or Concrete Block Foundation Walls · Leaning, Tilting. Over time, foundations will settle in other areas. Although homeowners may notice one side of their house sinking first, other sides of the foundation will. What Causes A Foundation To Sink? Foundations and the homes they support can sink when the soil surrounding them cannot bear their weight. Several factors. Some signs of foundation settlement include the following: · Cracks in concrete floors · Cracked walls · Windows won't open or close · Ripping and tearing in. A sinking floor in the center of your house is relatively common for certain types of older homes. My recommendation is to have a structural. Unlike settling, sinking is an uneven, progressive movement into the ground, manifesting through cracks in walls, misaligned doors, and uneven floors. It's as. Cracks in drywall throughout the house are reliable indicators of foundation settlement. Cracks will often be larger and more obvious in the home's upper levels. If you have noticed that the ground is sinking near your home's foundation, this can indicate that you may have serious foundation problems. A sinking foundation occurs when the foundation begins to settle unevenly into the earth. This phenomenon, known as differential settlement, takes place when. A sinking foundation is a serious issue that can lead to significant structural damage to your home if left unaddressed. Ignoring signs of foundation settlement. I have done it many times. First step is to ascertain if the house is level. If not, how far out and where. Then temporary shoring is put in to. A sinking foundation refers to a situation where the soil beneath a building's foundation settles unevenly, causing the foundation to sink or settle lower than. A sinking foundation refers to a situation where the soil beneath a building's foundation settles unevenly, causing the foundation to sink and become unlevel. Decreased Property Value. A home with a damaged foundation. Drying and Shrinking: As seen here, a lack of moisture causes the soil to dry up. The particles then shrink and leave voids in the ground. Homes built on shaky. Cracks in drywall throughout the house are reliable indicators of foundation settlement. Cracks will often be larger and more obvious in the home's upper levels. Foundation settlement and house movement can occur when one of these soil layers can't support the weight of the home. The Problem: Your home is showing signs. Stair-step cracking is very common in brick and concrete block walls and is a sure sign of foundation settlement. As the settlement house movement continues. When the foundation is sinking, your home could sink in one area while other areas are still in perfect condition. This sign of a sinking house may be harder to.

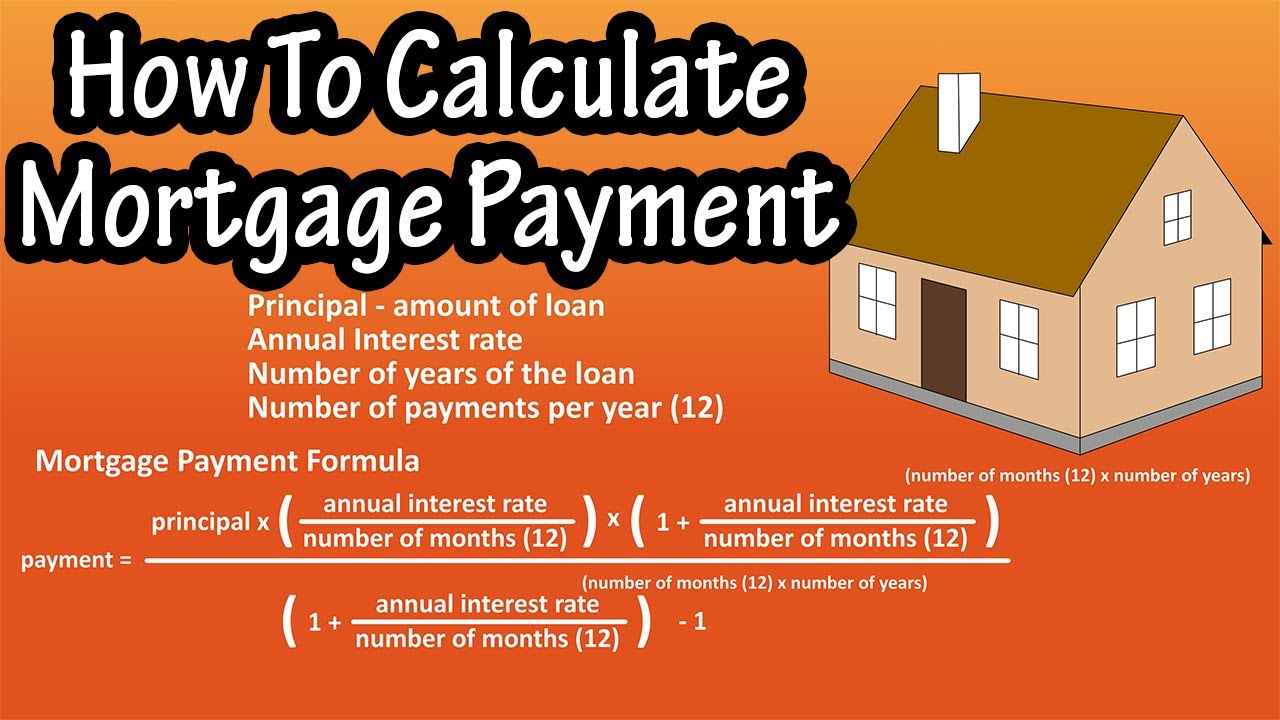

How To Calculate Mortgage Insurance Rate

Monthly PMI. Monthly cost of Private Mortgage Insurance (PMI). For loans secured with less than 20% down, PMI is estimated at % of your loan balance each. Mortgage Calculator with PMI · Loan information: · Prepayments: none · Total Payments $0. Total Interest $0 · Mortgage Term 15 years. Principal Balances by Year. The LTV ratio is calculated by dividing the amount borrowed by the appraised value or purchase price of the property, whichever is lower. The down payment size. Mortgage Payment Calculator with PMI, Taxes, Insurance & HOA Dues · $, house — $/month · Principal and interest. This is the amount that goes toward. Use the Insurance Premium Calculator to help you determine the applicable premium rate on an insured mortgage. Monthly interest rate: Lenders provide you an annual rate so you'll need to divide that figure by 12 (the number of months in a year) to get the monthly rate. How Do I Figure Out How Much PMI Will Pay? Your mortgage lender will determine the PMI rate and multiply the percentage by the loan balance. For example, if the. This calculator indicates how long it takes before ratios of loan balance to property value allow termination of PMI (mortgage insurance). How is PMI Calculated? · Down payment percentage (e.g., 5%, 10%, 15%) · Loan amount · Number of borrowers · Credit score · Property type · Debt-to-income ratio. Monthly PMI. Monthly cost of Private Mortgage Insurance (PMI). For loans secured with less than 20% down, PMI is estimated at % of your loan balance each. Mortgage Calculator with PMI · Loan information: · Prepayments: none · Total Payments $0. Total Interest $0 · Mortgage Term 15 years. Principal Balances by Year. The LTV ratio is calculated by dividing the amount borrowed by the appraised value or purchase price of the property, whichever is lower. The down payment size. Mortgage Payment Calculator with PMI, Taxes, Insurance & HOA Dues · $, house — $/month · Principal and interest. This is the amount that goes toward. Use the Insurance Premium Calculator to help you determine the applicable premium rate on an insured mortgage. Monthly interest rate: Lenders provide you an annual rate so you'll need to divide that figure by 12 (the number of months in a year) to get the monthly rate. How Do I Figure Out How Much PMI Will Pay? Your mortgage lender will determine the PMI rate and multiply the percentage by the loan balance. For example, if the. This calculator indicates how long it takes before ratios of loan balance to property value allow termination of PMI (mortgage insurance). How is PMI Calculated? · Down payment percentage (e.g., 5%, 10%, 15%) · Loan amount · Number of borrowers · Credit score · Property type · Debt-to-income ratio.

Find ways to reduce your mortgage insurance costs with this Navy Federal Credit Union calculator. Use the FHA Mortgage Insurance Calculator to calculate your estimated Up Front Mortgage Insurance, Monthly Mortgage Insurance and monthly payments. This FHA mortgage payment calculator figures the principal, loan interest, taxes, home insurance, and FHA mortgage insurance “PMI” costs. Private Mortgage Insurance (PMI) is calculated based on your credit score and amount of down payment. If your loan amount is greater than 80% of the home. Use the Insurance Premium Calculator to help you determine the applicable premium rate on an insured mortgage. calculator tool and are for illustrative purposes only and accuracy is not guaranteed. It is not an offer of mortgage insurance or in any way binding upon. Mortgage Calculator ; Loan Term? years ; Interest Rate? ; Start Date ; Include Taxes & Costs Below ; Annual Tax & Cost. Property Taxes? · Home Insurance? · PMI. Unlike most private mortgage insurance (PMI) policies, FHA uses an amortized premium, so insurance costs change along with your loan amount. The calculator. The LMI is calculated based on the size of your deposit and the total loan amount. You may be required to pay an LMI premium if you borrow over 80% of the. MIP means Mortgage Insurance Premium and it's required on all FHA loans. You will be required to pay up-front MIP at closing or roll it into your loan. FHA. Below is the monthly mortgage insurance premium (MIP) calculation with examples and pseudocode using the annual and upfront MIP rates in effect. Most people pay PMI in monthly installments. However, it can also be paid in a single premium, upfront. According to mortgage insurer Genworth, a borrower with. Before you can calculate your PMI, you need to determine your mortgage insurance rate. These typically vary from % – % of the original loan amount per. Quick to complete, quote, compare and share, MiQ, MGIC's rate finder platform provides mortgage insurance rates — with just a few pieces of data. PMI is estimated at following rates: % LTV = %, % LTV = %, % LTV = %, % LTV = %. The actual PMI is based on. Since you put down less than 20%, the lender charges private mortgage insurance (PMI), which is % of the loan balance, as shown below. PMI cost: $ per. This ranges from % to % depending on your down payment, home price and loan term. Upfront MIP: You can think of this as the FHA funding fee. % of. The monthly principal is determined by taking the entire principal and then dividing it by the term of the loan (30, 15, etc) and then further dividing that. Our Mortgage Calculator includes key factors like homeowners association fees, property taxes, and private mortgage insurance. Calculate payments. Enter your home price, down payment, ZIP code and credit score into our calculator Footnote(Opens Overlay) to see which mortgage option may.

Physician Signature Loans

Medical Providers Get Fast Easy Financing. Doctor, Physician, Dentist While a traditional bank might not understand the personal needs of physicians. Physician loans are specifically designed for doctors and other medical professionals and often have more flexible qualifying criteria than traditional mortgage. Physician loans can help doctors build their preferred lifestyles. Explore loans for doctors and physicians to drive new personal and professional initiatives. As a medical professional, you appreciate sound advice and good options. Our local home loan experts designed this exclusive mortgage package to solve the. Physicians that have been practicing for more than 10 years are limited to % financing. The following states are limited to 95% max LTV: CA, DC, FL, HI, ID. Private Banking Mortgages for Physicians · Key features. Bag with Dollar Sign. Up to % financing available with no PMI · Product details. Mortgages Designed. Get a Physician Personal Loan to Meet Your Financial Needs. Your private banker will personalize a loan that's right for you. Our solution: A mortgage program designed to help make homeownership easy and affordable for medical professionals including physicians, pharmacists. A TD Bank Medical Professional Mortgage is a home buying program with specific benefits designed to help physicians, surgeons, dentists, residents and fellows. Medical Providers Get Fast Easy Financing. Doctor, Physician, Dentist While a traditional bank might not understand the personal needs of physicians. Physician loans are specifically designed for doctors and other medical professionals and often have more flexible qualifying criteria than traditional mortgage. Physician loans can help doctors build their preferred lifestyles. Explore loans for doctors and physicians to drive new personal and professional initiatives. As a medical professional, you appreciate sound advice and good options. Our local home loan experts designed this exclusive mortgage package to solve the. Physicians that have been practicing for more than 10 years are limited to % financing. The following states are limited to 95% max LTV: CA, DC, FL, HI, ID. Private Banking Mortgages for Physicians · Key features. Bag with Dollar Sign. Up to % financing available with no PMI · Product details. Mortgages Designed. Get a Physician Personal Loan to Meet Your Financial Needs. Your private banker will personalize a loan that's right for you. Our solution: A mortgage program designed to help make homeownership easy and affordable for medical professionals including physicians, pharmacists. A TD Bank Medical Professional Mortgage is a home buying program with specific benefits designed to help physicians, surgeons, dentists, residents and fellows.

Medical Professional Loans As a physician or dentist with unique financial needs and time constraints, you can benefit from KeyBank's customized mortgages. Our exclusive in-house physician's mortgage loan program is designed specifically for medical residents/fellowships and physicians. Unlike a traditional mortgage, this home loan program is designed to help new medical professionals buy a home. Our Mortgage Loan Officers can help you decide. We Provide physician mortgage loans to doctors. The country's leader in offering Physician Mortgage Home Loan solutions to all Physicians. we have access to. A Physician Line of Credit can offer easy cash access for interns, residents, and fellows to manage personal expenses so they can focus on what matters. The Arbor Financial Credit Union low-cost, no-down-payment physician mortgage loans are available to doctors, dentists, and veterinarians. Click to apply. Include BMO physician loan when you shop around. We got a rate less than 6% when we closed last month and the loan includes a no-appraisal. Fair, affordable PRN Personal Loans designed for veterinarians, dentists, and physicians throughout their career: from school, through training, and into. Physician Loans, also called Doctor Loans, are exclusive loans given by specific mortgage lenders to dentists, orthodontists, optometrists, some veterinarians. For practicing doctors and dentists (MD, DO, DPM, DDS, DMD), we offer: · % maximum financing for loans up to $1 million. · 95% maximum financing for loans up. Personal Loans for Physicians. Realize your ambitions with loans only doctors can access, empowering physicians from training to practice. Explore Personal. A physician or “doctor” mortgage is a special loan program a lender puts in place to attract high-income clients by allowing health care professionals such as. lending products for medical professionals, including loans Our lenders serve as a personal guide through the loan process from initial application to loan. Our programs provide new and established doctors (MD, DO, DPM, DDS, DMD, DVM, and OD) with targeted benefits and simple solutions to meet home financing needs. Get a physician mortgage loan for the unique financial needs of doctors and more. We offer personal loans for physicians and medical professionals. Our programs provide new and established doctors (MD, DO, DPM, DDS, DMD, DVM, and OD) with targeted benefits and simple solutions to meet home financing needs. A physician loan is a mortgage solution designed to accommodate the unique financial needs of doctors, dentists, veterinarians and medical residents. SouthState offers physician mortgage loans for medical professionals, with up to % financing available. Apply now and get into your dream home. Unlike a traditional mortgage, this home loan program is designed to help new medical professionals buy a home. Our Mortgage Loan Officers can help you decide. A physician personal loan allows for a signed employment contract as proof of income. This is true for doctors and medical professionals that haven't started.

Emazing Lights On Shark Tank

K Followers, Following, Posts - @emazinglights on Instagram: " #1 Leader in Gloving & Light Shows ⭐As seen on Shark Tank. "Brian Lim, the CEO of the EmazingGroup, serial entrepreneur and Ecommerce Expert. He was on season 6 of ABC's Shark Tank. Robert Herjavec said Brian was “one. Founder Brian Lim appeared as a contestant on ABC's reality competition series Shark Tank on March 13, Lim accepted a deal from sharks Mark Cuban and. Emazing Lights Gloves Update | Shark Tank Season 6 The latest dance craze, according to Brian Lim, is called “gloving”, which is basically a dance show for. By the time Brian auditioned for the show, Emazing Lights and his other company I Heart Raves had already generated $13 million. By the end of. EmazingLights Emazing Lights Electro LED Light Up Glove Set - As Seen On Shark Tank - 1 Leader In Gloving & Light Shows Black Gloves Prices | Shop Deals. Light Shows from EmazingLight's Thursday Night Lights · · [TNL] [5/17/] Bubbles EmazingLights Shark Tank S6E22 Extended Teaser [lagu456z.site]. Emazing Lights lands deal in shark tank #edm #underground #lights #sharktank. CEO/Founder of @EmazingLights / @iHeartRaves / @INTOTHEAM. Deal with Mark Cuban and Daymond John on Shark Tank. Featured: Vice, Entrepreneur, Inc K Followers, Following, Posts - @emazinglights on Instagram: " #1 Leader in Gloving & Light Shows ⭐As seen on Shark Tank. "Brian Lim, the CEO of the EmazingGroup, serial entrepreneur and Ecommerce Expert. He was on season 6 of ABC's Shark Tank. Robert Herjavec said Brian was “one. Founder Brian Lim appeared as a contestant on ABC's reality competition series Shark Tank on March 13, Lim accepted a deal from sharks Mark Cuban and. Emazing Lights Gloves Update | Shark Tank Season 6 The latest dance craze, according to Brian Lim, is called “gloving”, which is basically a dance show for. By the time Brian auditioned for the show, Emazing Lights and his other company I Heart Raves had already generated $13 million. By the end of. EmazingLights Emazing Lights Electro LED Light Up Glove Set - As Seen On Shark Tank - 1 Leader In Gloving & Light Shows Black Gloves Prices | Shop Deals. Light Shows from EmazingLight's Thursday Night Lights · · [TNL] [5/17/] Bubbles EmazingLights Shark Tank S6E22 Extended Teaser [lagu456z.site]. Emazing Lights lands deal in shark tank #edm #underground #lights #sharktank. CEO/Founder of @EmazingLights / @iHeartRaves / @INTOTHEAM. Deal with Mark Cuban and Daymond John on Shark Tank. Featured: Vice, Entrepreneur, Inc

Brian Lim first stepped into the Shark Tank 2 years ago with Emazing Lights and blew the sharks out of the water. Robert Herjavec called him the most. Lim is asking for an investment of $k and offering a 5% equity in his company. Key Takeaways: Emazing Lights on Shark Tank. Product: LED gloves for gloving. Apr 11, - Explore Emazing Lights's board "Rave Gloves" on Pinterest. See more ideas Light Up Gloves, Finger Lights Featured on Shark Tank. Light Up. EmazingLights is pioneering the new Gloving Movement into a skillful expression of art, along with iHeartRaves, which provides wildly unique festival fashion. Brian Lim is a serial entrepreneur who has bootstrapped 3 ecommerce businesses that include lagu456z.site, lagu456z.site, lagu456z.site, which. Shark Tank (). Add photo. Top cast16 · Edit · Barbara Corcoran Self - Entrepreneur: Emazing Lights · Jonathan Kinkas · Self - Entrepreneur. Founder Brian Lim appeared as a contestant on ABC's reality competition series Shark Tank on March 13th, Lim accepted a deal from sharks Mark Cuban. Hiring at the Emazing Group: By Brian Lim. Mar 20, Why 'Shark Tank' investor Robert Herjavec says this entrepreneur might be. EmazingLights Electro Light Up Glove Set V2 - Flashing LED Finger Light Gloves for Raves & Light Shows Featured on Shark Tank: lagu456z.site: Toys & Games. EmazingLights, which sells LED embedded gloves to light Lim's appearance on Shark Tank wasn't the first time EmazingLights crashed while on Adobe Commerce. Oct 31, - Discover the latest updates on EmazingLights' appearance after Shark Tank. Learn about the exciting developments and insights. Light up the night with our selection of light toy products from EmazingLights. From LED gloves & accessories to poi. While supplies last. Featured on ABC's Shark Tank!. · Package contains: (10) Microlights, (20) Batteries, Premuim LEDs, Diffusers, White Emazing Magic Stretch Gloves, and a. Emazing Lights lands deal in shark tank #edm #underground #lights #sharktank. Simply browse an extensive selection of the best shark tank emazinglights and filter by best match or price to find one that suits you! You can also filter out. EDM hits Shark Tank with @EmazingLights lagu456z.site The Emazing Group - INTO THE AM / iHeartRaves / EmazingLights Magazine, Business Insider, CNBC, MTV, ABC's Shark Tank, LA Weekly, MSN, and more. Emazing Lights founder Brian Lim enters reality competition series, 'Shark Tank'. by: Lizzie Renck Mar 11, pinterest. The gloving business has. Shop EmazingLights eLite Element V2 LED Glove Set Light Up Toy - As Seen on Shark Tank! online at a best price in Bahrain. B00WYERRXS.

Vanguard Casino Etf

focuses on the casino properties' gaming operations, retail and online Best Vanguard ETFs By TTM Performance · Worst Vanguard ETFs By TTM Performance. The ETF with the largest weighting of Aristocrat Leisure is the VanEck Video Gaming and eSports UCITS ETF. Vanguard FTSE Developed Asia Pacific ex Japan UCITS. The VanEck Gaming ETF (BJK) aims to track the MVIS Global Gaming Index, which is designed to gauge the performance of companies involved in casinos and casino. Invest in Index Funds and Gamble a Little Casino Chips Poker Cards. If you index funds like Vanguard's VOO,VTSAX, and VUG. I tend to have a pretty. Hotel & Casino · Housing · Industrial Products · Insurance · Investment Management Vanguard Total World Stock Index. VT, The Roundhill Sports Betting & iGaming ETF (“BETZ”) is the world's largest gambling ETF. Vanguard. Charles Schwab. For all other registered brokerages. Casino ETF List. ETFs which hold one or more stocks tagged as: Casino Vanguard REIT ETF - DNQ, BUL, C, Pacer US Cash Cows Growth ETF, RFG, D. Learn everything about iBET Sports Betting & Gaming ETF (IBET). News, analyses, holdings, benchmarks, and quotes. VanEck Gaming ETF (BJK) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS Global Gaming Index . focuses on the casino properties' gaming operations, retail and online Best Vanguard ETFs By TTM Performance · Worst Vanguard ETFs By TTM Performance. The ETF with the largest weighting of Aristocrat Leisure is the VanEck Video Gaming and eSports UCITS ETF. Vanguard FTSE Developed Asia Pacific ex Japan UCITS. The VanEck Gaming ETF (BJK) aims to track the MVIS Global Gaming Index, which is designed to gauge the performance of companies involved in casinos and casino. Invest in Index Funds and Gamble a Little Casino Chips Poker Cards. If you index funds like Vanguard's VOO,VTSAX, and VUG. I tend to have a pretty. Hotel & Casino · Housing · Industrial Products · Insurance · Investment Management Vanguard Total World Stock Index. VT, The Roundhill Sports Betting & iGaming ETF (“BETZ”) is the world's largest gambling ETF. Vanguard. Charles Schwab. For all other registered brokerages. Casino ETF List. ETFs which hold one or more stocks tagged as: Casino Vanguard REIT ETF - DNQ, BUL, C, Pacer US Cash Cows Growth ETF, RFG, D. Learn everything about iBET Sports Betting & Gaming ETF (IBET). News, analyses, holdings, benchmarks, and quotes. VanEck Gaming ETF (BJK) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS Global Gaming Index .

But buying a travel ETF (exchange-traded fund) The AdvisorShares Hotel ETF focuses on hotels, accommodations, casinos (gaming), and related travel sub-. ETF Trust. ―. ―. QQQ. Invesco QQQ Trust. ―. ―. DIA. SPDR Dow Jones Industrial Average ETF Trust. ―. ―. IWM. iShares Russell ETF. ―. ―. VOO. Vanguard. Vanguard. The BAD Investment Company is A Large Cap ETF that tracks the largest domestic Casino/Gaming, Alcohol, Cannabis & Pharmaceutical companies. For the 12 months ended August 31, , Vanguard ESG International Stock ETF Casino Guichard Perrachon SA, 4,, GL Events, , Vicat SA, , Gaming ETFs invest in stocks of companies that derive a substantial portion of their revenues from the casino gaming industry. These include casino. William Galvin announced a 'sweep' of firms offering the new ETFs, which he compared to gambling at a casino. The Vanguard Total Bond Market ETF, with assets. Get an introduction to the MSOS ETF directly from the portfolio manager, Dan Ahrens. , MONARCH CASINO & RESORT INC, 4,, , ,, ETF for gambling, tobacco, oil, weapons etc? Investment. the Vanguard FTSE ETF is now the most expensive fund. upvotes · ETF. Vanguard ESG Developed Europe All Cap UCITS ETF. Vanguard ESG Casino Guichard Perrachon. SA. %. Carmila SA REIT. Learn everything you need to know about VanEck Gaming ETF (BJK) and how it ranks compared to other funds. Research performance, expense ratio, holdings. To be initially eligible for the index, companies must generate at least 50% of their revenues from gaming. Gaming includes casinos and casino hotels, sports. BJK - VanEck Vectors Gaming ETF, 22,, , 2,, , NP, GXUS Vanguard Total World Stock Index Fund ETF Shares This fund is a listed. casino gaming software for online and retail sportsbook and casino gaming products. Best Vanguard ETFs By TTM Performance · Worst Vanguard ETFs By TTM. I consider myself one of these average people which is why I went to etf's and bogle style. The BIG difference between a casino and investing is. ETF Trust. ―. ―. QQQ. Invesco QQQ Trust. ―. ―. DIA. SPDR Dow Jones Industrial Average ETF Trust. ―. ―. IWM. iShares Russell ETF. ―. ―. VOO. Vanguard. ETFs which hold one or more stocks tagged as: Casinos In Macau. Symbol, Grade, Name, Weight. BJK, C, Market Vectors Gaming ETF Vanguard Total World Stock. Gaming industry ETFs are exchange-traded funds that invest in casino and sports betting companies for the purpose of generating returns that match an. Vanguard's First Index Investment Trust (known today as the Vanguard Index Fund) casino”: leveraged and inverse ETFs, like one built to do the. VTIP Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares. +%. IEF iShares Year Treasury Bond ETF. +%. FCAL First. Vanguard FTSE Japan UCITS ETF USD Hedged Acc, %. Equity. Japan. , %, 62 VanEck Video Gaming and eSports UCITS ETF, %. Equity. World.

Crowd Source Loans

Crowdfunding raises funds for a business from a large number of people, called crowdfunders. Crowdfunders aren't technically investors, because they don't. Crowdfunding raises funds for a business from a large number of people, called crowdfunders. Crowdfunders aren't technically investors, because they don't. Personal loans crowdfunding platforms operate in 18 countries and focus on Equity, Debt, P2P lending, Reward, Donation and Mini-bonds providing different. Our peer to peer lending platform directly connects your business with a crowd of investors on our marketplace who can fund your finance request in days. Unlike taking out a traditional loan, peer-to-peer (P2P) lending lets you borrow money directly from individual investors rather than from a financial. Crowdfunding is most often used by startup companies or growing businesses as a way of accessing alternative funds. It is an innovative way of sourcing funding. We are a vertically integrated, regional direct hard money lender that sources, underwrites, funds, and services real estate loans throughout the Northeast. Unlike taking out a traditional loan, peer-to-peer (P2P) lending lets you borrow money directly from individual investors rather than from a financial. Major players in the field include such platforms as Funding Circle, Kiva, LendingClub, Prosper, and Upstart, among others. Key Takeaways. Peer-to-peer (P2P). Crowdfunding raises funds for a business from a large number of people, called crowdfunders. Crowdfunders aren't technically investors, because they don't. Crowdfunding raises funds for a business from a large number of people, called crowdfunders. Crowdfunders aren't technically investors, because they don't. Personal loans crowdfunding platforms operate in 18 countries and focus on Equity, Debt, P2P lending, Reward, Donation and Mini-bonds providing different. Our peer to peer lending platform directly connects your business with a crowd of investors on our marketplace who can fund your finance request in days. Unlike taking out a traditional loan, peer-to-peer (P2P) lending lets you borrow money directly from individual investors rather than from a financial. Crowdfunding is most often used by startup companies or growing businesses as a way of accessing alternative funds. It is an innovative way of sourcing funding. We are a vertically integrated, regional direct hard money lender that sources, underwrites, funds, and services real estate loans throughout the Northeast. Unlike taking out a traditional loan, peer-to-peer (P2P) lending lets you borrow money directly from individual investors rather than from a financial. Major players in the field include such platforms as Funding Circle, Kiva, LendingClub, Prosper, and Upstart, among others. Key Takeaways. Peer-to-peer (P2P).

Direct or P2P lending also goes by other names, such as marketplace lending, crowdlending, and social lending. If you've never heard about this alternative. All loan requests are subject to verification, lender proposal and the requestor's final acceptance. Tips and Donations are voluntary. For funders, returns are. Because loans are typically used for real estate development, this is a familiar model in the new crowdfunding industry, which helps funding become available. Crowd funding or peer-to-peer lending is rising. SWBF can help with Crowd Funding & unsecured Business Loans in Bath Bristol Exeter & beyond. Prosper today with online loans & more · Borrow up to $50K · Next-day funding · No pre-payment penalty. Additionally, more companies are using equity crowdfunding for their Series A. Series A is a point at which many startups tend to fail. In a phenomenon known as. Long-term investing made easy. Grow your money with a unique mix of alternative and traditional assets. Invest in loans sources so we can measure and improve. Instead of having one main crowdfunding page where everybody donates, people can have multiple individual fundraising pages with peer-to-peer fundraising, which. Diversified debt fund with ~$M in active loans and a 6+-year track record of returns (avg. Advisory services are offered through CrowdStreet Advisors, LLC. This Report contains an analysis of the current regulatory framework for lending-based and investment-based crowdfunding platforms in the following countries. LenderKit is your comprehensive solution for building and growing a distinctive P2P lending or debt crowdfunding platform. The peer-to-peer investment software. Peer-to-peer lending (sometimes called crowdlending), is a direct alternative to a bank loan with the difference that, instead of borrowing from a single. Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet. The relationship-based lending app, reenvisioning the way friends and family lend and borrow money. Investors provide funds in exchange for the right to have their money paid back with interest according to the repayment terms specified in a loan contract or. P2P (or marketplace) lending lets someone needing a personal or business loan borrow money from an investor. Crowdfunding loans provide an alternative avenue to traditional bank loans for small businesses. Offered by many peer-to-peer lending platforms, you are. Crowdfunding. Crowdfunding involves individual investors collectively providing finance for a business for something in return, either equity in the company or. Im from baltics and only use lagu456z.site whi provide funding for farmers and agro businesses in baltics, portugal, romania, bulgaria and. loans and a recent crowdsourcing campaign. — Roxana Popescu, San Diego Union These examples are programmatically compiled from various online sources to.